Now, I admit that I'm not a lawyer so deciphering bills is difficult and painstakingly displeasing. City residents would be wise to do their own investigative work if so inclined. However, there is a great summary document that should help with the details. Remember that the bill passed so most all other provisions in the bill are already in affect. The first section of the summary is most relevant to the tax increase.

Although SB136 is pretty much the same as HB362, the senate bill seems to only have provisions for distributing sales tax to the cities based on where the tax was collected whereas with HB362 20% of the revenue collected was distributed based on population so Elk Ridge would at least get some of the revenue. With SB136 I'm not sure if Elk Ridge would get any additional funding for roads.

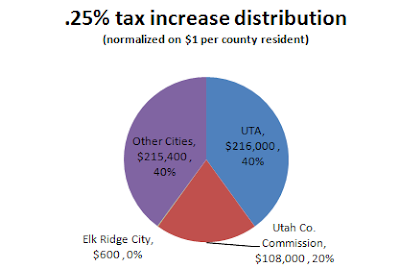

Anyone can review my previous blog on HB362 if interested in the distribution details and some of the reasons I was not in favor. It clearly showed that 80% the increased tax would be distributed away from Elk Ridge. With this new bill the amount distributed away could be 100%.

As previously mentioned, a big problem with this bill is that it grants the County Commission authority to enact the tax with absolutely no input from the residents. No vote, no hearing, nothing! They can simply put it on their agenda and vote. In fact, Commissioner Graves has already stated that this is his intention. Apparently the State Legislature didn't like how the prop 1 vote turned out so they threw us under the proverbial bus! This seems to be how they do business these days.

You should also know that Salem has already passed a resolution supporting this tax. I suggest you read this article about Salem's decision. We should all respect their decision and I certainly do.

The county recently asked if I thought the City Council, and ultimately the Elk Ridge residents, would be supportive of the tax. After thinking this through, I responded with a No. I hope the majority of Elk Ridge residents agree and I hope the county doesn't play dirty politics by holding back funding in other areas. I just had to make a choice based on the facts. BTW, here is the sample resolution drafted by the Utah League of Cities and Towns for the cities to use.

I fully expect the county to enact the tax because cities do need more road funding, and the county gets their 20%. IF the time comes (it's NOT time and there are NO plans) that our city needed to raise additional road funds, I personally would rather have my property taxes raised or a city road assessment levied so Elk Ridge would directly receive the vast majority of the revenue and avoid giving 40% to UTA for projects that have no material impact to our residents. I don't mind giving 20% to the county because there is a 20% chance we could see improvements that would have a positive impact.

As a side note, the last few legislative sessions have been rather unfavorable, even hostile, towards local municipalities as the State Legislators continue to pass unfunded mandates and restrictions that we must comply with. Maybe I will blog about this too.